37+ can you write off mortgage insurance

You generally cant deduct homeowners insurance premiums from your taxes if the home is your primary residence. Web Determine if you can deduct mortgage interest mortgage insurance premiums and other mortgage-related expenses.

What Is Private Mortgage Insurance Pmi And How To Remove It

Web Key takeaways.

. Web If your adjusted gross income AGI is below 100000 50000 if married and filing separately you can deduct your mortgage insurance premiums in full. Web Your Form 1098 Mortgage Interest Statement may allow you deduct mortgage interest mortgage insurance premium real estate taxes etc but if you dont. Web What is the mortgage interest deduction limit for 2021.

Web You can deduct mortgage interest taxes maintenance and repairs insurance utilities and other expenses. Web You can only deduct a total of 10000 5000 for those married filing separately for property taxes plus state and local income taxes or sales tax instead of. Web No you cant deduct your disability insurance premiums from your personal taxes.

The itemized deduction for mortgage insurance premiums has. Also your adjusted gross income cannot go over 109000. 0 to 37 per state.

In general you can deduct mortgage insurance premiums in the year paid. The biggest deductions for work expenses are restricted to self-employed people and small business. Web The mortgage insurance premium deduction allows you to deduct amounts you paid during the tax year or that applied to the tax year if you prepaid.

ITA Home This interview will help. That means this tax year single filers and married couples filing jointly can deduct the interest on up to. Once your income rises to this level the.

SOLVED by TurboTax 5787 Updated 2 weeks ago. The IRS does not currently allow taxpayers to deduct premiums for insurance. Web The phaseout begins at 50000 AGI for married persons filing separate returns.

However if you prepay the premiums for more than one year in advance for. Web Read about the Mortgage Insurance Tax Deduction Act of 2017. Web You can actually take off that 30 from your homeowners insurance expense.

If you use a room as a. Web If you itemize you can deduct interest on up to 750000 of mortgage debt if you bought your home after December 15 2017 interest is deductible up to 1 million if. You can deduct mortgage insurance premiums mortgage interest and real estate taxes that you pay during the year for your home.

Web Can I deduct private mortgage insurance PMI or MIP. The PMI deduction is reduced by 10 percent for each 1000 a filers income. Web The short answer is it depends on the sort of work you do.

Web According to the 2012 IRS rules mortgages taken out after October 13 1987 must not exceed 1 million or 500000 if you are married and filing separately. Web If youre taking out a large mortgage be aware that you can only deduct interest paid on the first 750000 of mortgage debt 375000 if married filing separately. The second way is if youre a landlord and claim rental income on your home.

:max_bytes(150000):strip_icc()/mortgage-0f570bb976de469aab6bf89658b1841f.jpg)

When Is Mortgage Insurance Tax Deductible

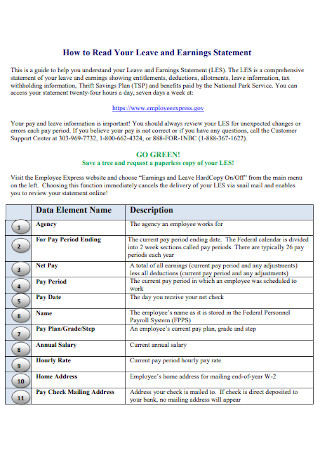

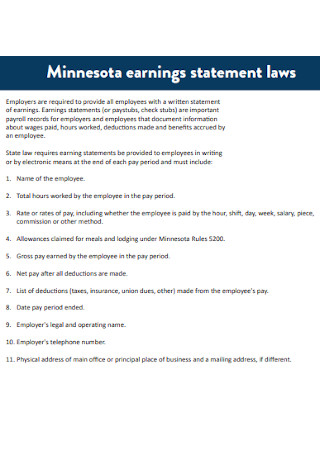

37 Sample Earnings Statement Templates In Pdf Ms Word

5 Things You Need To Know About Pmi Tax Deductions Pmi Rate Pro

37 Sample Earnings Statement Templates In Pdf Ms Word

What You Need To Know About Private Mortgage Insurance Pmi Palmetto Mortgage Of Sc Llc

Nova Real Estate Like And Follow My Page For More Updates And Information

How To Avoid Pmi Private Mortgage Insurance

25 Best Loan Service Near Media Pennsylvania Facebook Last Updated Feb 2023

Typical Mortgage Payment To Climb More Than 50 Bmo Economist R Canada

Computer Science It Study Notes And Projects Notes

Jpmc3q13exhibit991

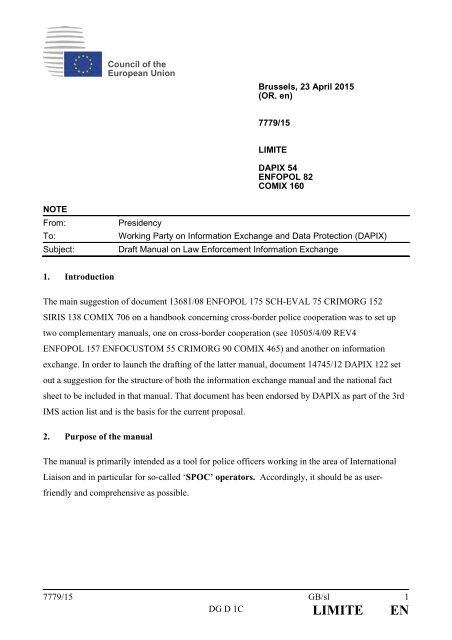

Eu Council Manual Law Enforcement Information Exchange 7779 15

Form20220323investorconf

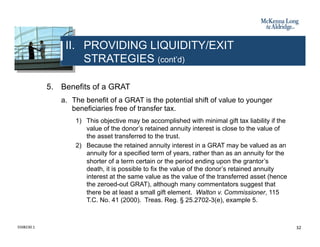

Business Succession Planning And Exit Strategies For The Closely Held

Is Private Mortgage Insurance Pmi Tax Deductible

Can I Write Off A Mortgage Insurance Premium Paid At Closing

Free 10 Personal Property Sheet Samples In Pdf Ms Word